Mergers & Acquisitions, Publishers & Curriculum, Required, Technology - Written by Wired Academic on Saturday, May 5, 2012 8:22 - 0 Comments

M&A: Microsoft Buys Into Barnes & Nobles Nook eReader & College Bookstore Business

![]() Photo Credit: Let Ideas Compete via Compfight

Photo Credit: Let Ideas Compete via Compfight

What’s the implications of Microsoft investing $300 million into the eBook business this week. It bought a 17.6% stake this week in a subsidiary that joins Barnes & Noble’s Nook e-reader and college bookstores businesses. That means Microsoft will compete directly with Amazon.com. We see this as further indication that education technology and digital learning is a place where big money and big technology is heading to create disruption, innovation and profits. Here’s what other media reported and commented about regarding the deal:

Karen Weise at Bloomberg Businessweek reports:

The transaction, which will turn the software maker into a direct competitor of Amazon (AMZN), values the Nook business at $1.7 billion—a rare bit of good news for the struggling bookseller. That’s more than double Barnes & Noble’s total market capitalization. The partners said the investment would help speed the introduction of the Nook bookstore abroad and fund research and development of new e-ink Nook readers and tablets. Microsoft announced last year it would discontinue its own e-reader app effective August 2012. Via BusinessWeek

Steven D. Jones at Dow Jones Newswires reports:

But as Microsoft has done with Nokia Inc. (NOK) in smartphones and Bing in Internet search, the software giant is playing catch-up without the benefit of profits. Barnes & Noble’s Nook business is on track to lose about $260 million on $1.1 billion in revenue this year, after losing about $200 million last year, says analyst Brett Harriss of Gabelli & Co., whose parent company GAMCO owns 59,000 shares of Barnes & Noble.

Since its launch in 2010, the Nook has pushed aside the Sony Reader from Sony Corp. (SNE) to become the No. 2 e-reader behind Amazon’s Kindle. In the quarter ended in January, sales at B&N.com soared 31.6% from a year earlier because of growth in the Nook business. But losses persist, and even though the profitable college book business also will be part of NewCo, losses on the digital side will make NewCo a money loser in 2012.

For its investment, Microsoft will acquire 18% of NewCo, which includes all of the Nook hardware, trademarks and intellectual property. The venture also will have ownership of the digital relationships with publishers, all Nook customer lists and the digital lockers where users access content. With its stake in NewCo, Microsoft can influence the development of the Nook and make it an attractive new application for its Windows 8 operating system. But it’s not just operating systems and processing power, Microsoft also acquired a relationship with Nook subscribers. Via WSJ.com

Matthew Yglesias at Slate.com writes:

This amounts to a bailout of Barnes & Noble so potentially transformative that it’s extraordinary Microsoft didn’t get a larger equity stake. In principle, Barnes & Noble should have strong prospects in the e-book market. It has a decent device, a brand people recognize and associate with books, and longstanding relationships with book publishers. Its problem is that the other two major e-book sellers—Apple and Amazon—are cash-rich, growing technology companies. Barnes & Noble, by contrast, is a big-box retailing business that’s facing structural decline in the digital era. Over the long haul, it simply wouldn’t have the resources to invest in keeping the Nook platform competitive. Microsoft is the perfect partner. While Microsoft no longer strikes fear into the hearts of men the way it did in its late ’90s heyday, selling Windows and Office to PC users continues to be a ridiculously profitable business. Microsoft’s long-term future is probably bleak, and one possible response to that would be for it to pay out huge dividends while awaiting inevitable decline. But real companies don’t act like that, and instead Microsoft has been throwing its considerable savings around in a quest for growth. That’s brought us Bing, a socially valuable Google competitor that hasn’t yet made any money, the huge push of the Lumia 900, and set of Apple-like copycat retail stores. And now Nook.

The strategic partnership ensures that Microsoft’s Windows phone products will have a high-quality e-reader and book-purchasing experience via a Nook app and existing retail channel. Presumably, it also means that Nook hardware will transition away from its current Android-derived base and onto Microsoft’s forthcoming tablet operating system. Microsoft doesn’t need Barnes & Noble the way Barnes & Noble needs Microsoft, but this is yet another way to try to channel the firm’s PC profits into a new line of business.

It’s funny to describe a joint venture Microsoft and Barnes & Noble—two companies that dominated the world just a few years ago—as an underdog, but that’s exactly what it is. Still, Newco is bound to be a strong contender. And the pace of change illustrates why all the hand-wringing about competition in the e-book market is misguided. When news surfaced that the DOJ was considering bringing e-book price-fixing charges against incumbent publishers for an alleged conspiracy with Apple, I thought it was ridiculous a ridiculous idea, comparable to worrying about a horse-and-buggy cartel five years into the automobile era. Via Slate.com

Edwin Durgy at Forbes.com writes:

For all those who were short Barnes & Noble heading into Monday April 30, this past week was an unexpectedly terrible one. Barnes & Noble is, after all, built on not one, but two dying technologies: big box, brick and mortar retailing and the printed word. Sure, the company has the Nook e-reader, but what is by most accounts a fine piece of hardware seemed more like a beautiful swan song than a pivot on which to reinvent the entire company, especially in the face of Apple and Amazon’sestablished digital content distribution channels and immensely popular devices. But with Microsoftinjecting $300 million (almost half Barnes & Noble’s pre-announcement market capitalization) into a jointly owned e-book and e-reader marketing subsidiary, all that changed. Barnes & Noble shares shot up more than 80% on the news, ultimately netting a 31% gain on the week over last Friday. For the founder and Chairman of 26 year old book retailer, Leonard Riggio, the bounce meant a huge increase in his net worth. Riggio’s nearly 17 million Barnes & Noble shares were worth $302.9 million when markets opened Friday morning, $82.8 million more than they were a week ago. Via Forbes

Campus Buzz

We welcome Tips & Pitches

Latest WA Original Features

-

“Instreamia” Shakes Loose Moss By Launching Spanish Language Mini-MOOC

-

Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

-

Open University Enters Battle Of The MOOCs, Launches “FutureLearn”

-

Alvaro Salas As A Case Study In Crowd-Funding An Ivy-League Education

-

Jonathan Mugan: How To Build A Free Computer Within A Computer For Your Child

Paul Glader, Managing Editor

@paulglader

Eleni Glader, Policy Editor

Elbert Chu, Innovation Editor

@elbertchu

Biagio Arobba, Web Developer

@barobba

Contributors:

Michael B. Horn

@michaelbhorn

Derek Reed

@derekreed

Annie Murphy Paul

@AnnieMurphyPaul

Frank Catalano

@FrankCatalano

Ryan Craig

@UniVenturesFund

Jonathan Mugan

@JMugan

Terry Heick

@TeachThought

Alison Anderson

@tedrosececi

Ravi Kumar

@ravinepal

The Pulitzer Prize winning investigation newsroom digs into for-profit education.

-

Most Viewed

- Inside Ashford University: A former staffer talks to WiredAcademic

- Infographic: A History Of Information Organization From Stone-Age To Google

- Davos: 12-Year-Old Pakistani Prodigy Girl Talks About Her Online Learning

- Open University Enters Battle Of The MOOCs, Launches "FutureLearn"

- Guest Column: Why Steve Jobs would have loved digital learning

-

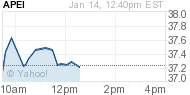

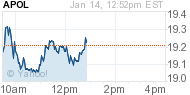

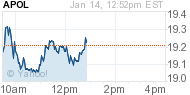

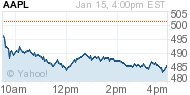

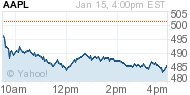

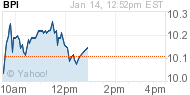

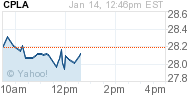

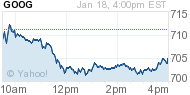

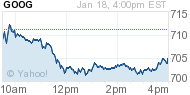

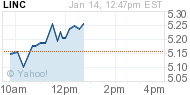

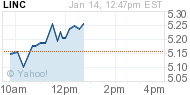

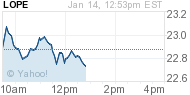

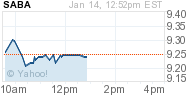

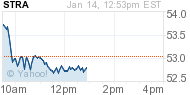

MARKET INTRADAY SNAPSHOT

- Education & Tech Companies We Follow

| APEI | 41.33 |  -0.16 -0.16 |  -0.39% -0.39% | ||

| APOL | 19.13 |  -0.18 -0.18 |  -0.93% -0.93% | ||

| AAPL | 448.85 |  -11.14 -11.14 |  -2.42% -2.42% | ||

| BPI | 10.83 |  -0.23 -0.23 |  -2.08% -2.08% | ||

| CAST | 0.11 |  0.00 0.00 |  +0.00% +0.00% | ||

| CECO | 4.07 |  -0.11 -0.11 |  -2.63% -2.63% | ||

| COCO | 2.31 |  -0.085 -0.085 |  -3.55% -3.55% | ||

| CPLA | 32.60 |  -0.30 -0.30 |  -0.91% -0.91% | ||

| DV | 31.74 |  -0.32 -0.32 |  -1.00% -1.00% | ||

| EDMC | 3.86 |  -0.09 -0.09 |  -2.28% -2.28% | ||

| ESI | 18.78 |  -0.32 -0.32 |  -1.68% -1.68% | ||

| GOOG | 792.46 |  -14.39 -14.39 |  -1.78% -1.78% | ||

| LINC | 6.23 |  -0.20 -0.20 |  -3.11% -3.11% | ||

| LOPE | 26.38 |  +0.82 +0.82 |  +3.21% +3.21% | ||

| PEDH | 0.45 |  0.00 0.00 |  +0.00% +0.00% | ||

| PSO | 18.41 |  -0.26 -0.26 |  -1.39% -1.39% | ||

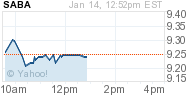

| SABA | 8.49 |  -0.34 -0.34 |  -3.85% -3.85% | ||

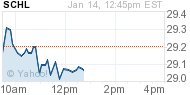

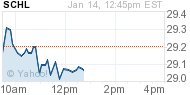

| SCHL | 31.09 |  +0.04 +0.04 |  +0.13% +0.13% | ||

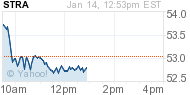

| STRA | 52.00 |  -0.27 -0.27 |  -0.52% -0.52% | ||

| WPO | 416.84 |  -2.01 -2.01 |  -0.48% -0.48% |

Domestic, For-Profit, Gainful Employment, Infographics, Personalized Learning, Private, Public, Required, Universities & Colleges - Jan 31, 2013 6:09 - 0 Comments

Infographic: To Get A Degree Or Not To Get A Degree? Here Is An Answer

More In For-Profit

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Graphical Profile Of Today’s Online College Student

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

Cost of Education Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Gainful Employment Graduation Rates Legislation Minorities Opinion Recruitment Regulatory Required Retention Rates Student Loans Universities & Colleges

Blended Learning, International, MOOCs, OER - Open Educational Resources, Open Source Education, Personalized Learning, Required, Technology, Universities & Colleges - Feb 19, 2013 19:50 - 1 Comment

OU’s FutureLearn Inks Six New MOOC Institutions & Aims To Export Courses To India

More In Technology

- MOOC Monitor: Must Reads This Week

- Infographic: Rise of the MOOCs

- Smart Cities Part II: Why DC Is The Planetary Hub Of Online Learning

- Five Questions: Polling EdTech Startup UnderstoodIt’s Liam Kaufman

- Infographic: The Future of Higher Education

Cost of Education, Domestic, Early Childhood Education, Education Quality, Friend, Fraud, or Fishy, Legislation, Minorities, Parents, Public, Required - Feb 18, 2013 4:59 - 0 Comments

Important Early Questions Over Obama’s Early Childhood Program Ambitions

More In Friend, Fraud, or Fishy

- Should For-Profit Companies Manage K-12 Schools? A Skeptical Review

- A Letter To Sen. Tom Harkin About For-Profit Charter Schools

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- Opinion: The Problem With Deceptive Degree Aggregators In The Search For Online Courses & Degrees

- How For-Profit Colleges Major In Marketing & Fail Education

Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Graduation Rates Minorities Recruitment Required Retention Rates Universities & Colleges

Leave a Reply