Continuing Education, Domestic, Economics & Business, Gamification, K-12, Required, Startups, Universities & Colleges - Written by Wired Academic on Thursday, May 3, 2012 18:17 - 0 Comments

New Game Aims To Teach Students Financial Literacy

This post (“New Game Aims To Teach Students Financial Literacy“) by Sarah Cargill originally appeared on GettingSmart.

A 2008 study by the Jumpstart Coalition for Personal Financial Literacy found that high school seniors in 2008 only scored an average of 48.3% on a financial literacy test. Only thirteen states in the United States have legislation requiring financial literacy topics for graduating twelfth graders. Yet, many states have failed to provide the funding to adequately cover these lessons, forcing it to be jammed into Civics, History and Economics courses.

While online calculators can compute loan payments, budget sheets, and other mathematical equations for everyday life, they don’t teach the reasoning and meaning behind these numbers to improve financial decision making. Many college students today graduate with thousands of dollars in loan debt and little to no knowledge about interest rates and consolidation.

A large part of the financial crisis we’re currently facing can be attributed to predatory lending, says Britt Carr, an interactive learning technology consultant and developer at Advanced Authoring.

“If more people were more financially literate, they may have thought twice about buying a home that they wouldn’t be able to afford in a few years,” says Carr.

To address the void of financial literacy in K-12 and college classrooms, Carr has set out to create a mobile game to teach students how to achieve happy, healthy retirement through game play. Carr was first introduced to the idea to create a game around personal financial planning to help teach financial literacy to college students by his wife.

“My wife was teaching a class about aging to a bunch of college students who planned to retire at 55 without any clear idea about how to accomplish this,” he says. ”The traditional method of teaching personal finance provides no context for students today. There’s no real meaning to them.”

When visiting classrooms to learn more about the ways that students are learning these subjects, Carr was shocked to find out that one local high school spent only two weeks covering personal finance in the midst of a World History course.

“How can you teach teens a lifetime of critical concepts in two weeks?” asks Carr. “Unless you have their undivided attention, you can’t.”

What’s more, he interviewed several college students on a major college campus who could not define or apply concepts such as an adjustable rate mortgage, term life insurance, deductibles, or more. These are basic skills that high school and college students are ill equipped to face after graduation.

Carr argues that students today may not need to know how to balance their checkbooks, but they will need to know valuable financial skills to manage their expenses in new ways. ”When it comes to managing a lifetime of money,” says Carr, “the lessons need to be meaningful to the learner.”

Carr’s vision for the mobile game, The American Dream, requires students to make financial decisions to reach retirement by staying out of debt, balancing a budget, and coping with unexpected life events. The game is personalized to each player with a few preliminary questions targeting attitude and lifestyle preferences.

“It’s not all about math,” says Carr. “Think: The Sims meets Survivor.”

The game sets the groundwork for monthly budgets by giving the player choices in a career and starting salary, rent or mortgage, and transportation. It then takes you through a simulated life, facing events such as increased inflation, changes in cost of living, and pay raises. It seeks to simulate positive and negative changes that affect financial decision making.

Carr is working on two versions of the game. The commercial version will integrate with Facebook and allow players to compare scores and choices with friends who are also playing online.

An educational version will allow an educator to set the market dynamics in order to reflect current events. This gives teachers the ability to teach around natural disasters, stock market and real estate trends, and more. This gives the educator the opportunity to monitor student choices and facilitate discussion or misunderstandings.

“I wanted to leave room for discussing how the gameplay mirrors the real world,” says Carr. “My idea is to deliver information in an engaging, personalized, low risk format as homework. So that when students get into class, they can discuss strategies and situations with their teacher.”

Carr is raising $45,000 in funding for The American Dream Mobile Game on Kickstarter and on Carr’s website at brittcarr.com/contribute.

Campus Buzz

We welcome Tips & Pitches

Latest WA Original Features

-

“Instreamia” Shakes Loose Moss By Launching Spanish Language Mini-MOOC

-

Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

-

Open University Enters Battle Of The MOOCs, Launches “FutureLearn”

-

Alvaro Salas As A Case Study In Crowd-Funding An Ivy-League Education

-

Jonathan Mugan: How To Build A Free Computer Within A Computer For Your Child

Paul Glader, Managing Editor

@paulglader

Eleni Glader, Policy Editor

Elbert Chu, Innovation Editor

@elbertchu

Biagio Arobba, Web Developer

@barobba

Contributors:

Michael B. Horn

@michaelbhorn

Derek Reed

@derekreed

Annie Murphy Paul

@AnnieMurphyPaul

Frank Catalano

@FrankCatalano

Ryan Craig

@UniVenturesFund

Jonathan Mugan

@JMugan

Terry Heick

@TeachThought

Alison Anderson

@tedrosececi

Ravi Kumar

@ravinepal

The Pulitzer Prize winning investigation newsroom digs into for-profit education.

-

Most Viewed

- Inside Ashford University: A former staffer talks to WiredAcademic

- Infographic: A History Of Information Organization From Stone-Age To Google

- Davos: 12-Year-Old Pakistani Prodigy Girl Talks About Her Online Learning

- Open University Enters Battle Of The MOOCs, Launches "FutureLearn"

- Pearson Llc + Google Expands LMS Business With "OpenClass" System

-

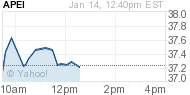

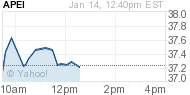

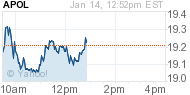

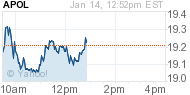

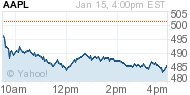

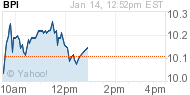

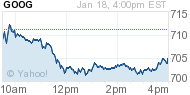

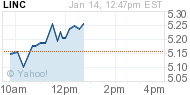

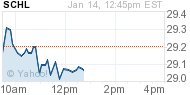

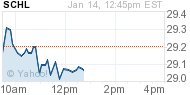

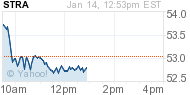

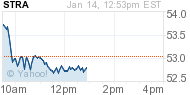

MARKET INTRADAY SNAPSHOT

- Education & Tech Companies We Follow

| APEI | 40.20 |  -0.17 -0.17 |  -0.42% -0.42% | ||

| APOL | 19.01 |  +0.33 +0.33 |  +1.77% +1.77% | ||

| AAPL | 460.16 |  -6.43 -6.43 |  -1.38% -1.38% | ||

| BPI | 10.74 |  -0.09 -0.09 |  -0.83% -0.83% | ||

| CAST | 0.11 |  +0.01 +0.01 |  +10.00% +10.00% | ||

| CECO | 4.08 |  -0.02 -0.02 |  -0.49% -0.49% | ||

| COCO | 2.40 |  -0.02 -0.02 |  -0.83% -0.83% | ||

| CPLA | 32.03 |  -0.41 -0.41 |  -1.26% -1.26% | ||

| DV | 30.69 |  +0.36 +0.36 |  +1.19% +1.19% | ||

| EDMC | 4.03 |  +0.07 +0.07 |  +1.77% +1.77% | ||

| ESI | 18.34 |  +0.04 +0.04 |  +0.22% +0.22% | ||

| GOOG | 792.89 |  +5.07 +5.07 |  +0.64% +0.64% | ||

| LINC | 6.20 |  +0.06 +0.06 |  +0.98% +0.98% | ||

| LOPE | 25.03 |  +0.36 +0.36 |  +1.46% +1.46% | ||

| PEDH | 0.45 |  0.00 0.00 |  +0.00% +0.00% | ||

| PSO | 18.51 |  -0.27 -0.27 |  -1.44% -1.44% | ||

| SABA | 8.61 |  -0.16 -0.16 |  -1.82% -1.82% | ||

| SCHL | 30.87 |  +0.46 +0.46 |  +1.51% +1.51% | ||

| STRA | 51.95 |  -1.54 -1.54 |  -2.88% -2.88% | ||

| WPO | 414.41 |  +5.35 +5.35 |  +1.31% +1.31% |

Domestic, For-Profit, Gainful Employment, Infographics, Personalized Learning, Private, Public, Required, Universities & Colleges - Jan 31, 2013 6:09 - 0 Comments

Infographic: To Get A Degree Or Not To Get A Degree? Here Is An Answer

More In For-Profit

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Graphical Profile Of Today’s Online College Student

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

Cost of Education Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Gainful Employment Graduation Rates Legislation Minorities Opinion Recruitment Regulatory Required Retention Rates Student Loans Universities & Colleges

MOOCs, Required, Technology - Feb 16, 2013 10:04 - 0 Comments

MOOC Monitor: Must Reads This Week

More In Technology

- Infographic: Rise of the MOOCs

- Smart Cities Part II: Why DC Is The Planetary Hub Of Online Learning

- Five Questions: Polling EdTech Startup UnderstoodIt’s Liam Kaufman

- Infographic: The Future of Higher Education

- Anne Collier: Study Shows eBooks Gaining Larger Share & Boosting Overall Reading Habits

Domestic K-12 Parents Reading / Literature Required Technology

Charter, Cost of Education, Domestic, Education Quality, Friend, Fraud, or Fishy, K-12, Minorities, Regulatory, Required - Feb 7, 2013 12:23 - 0 Comments

Should For-Profit Companies Manage K-12 Schools? A Skeptical Review

More In Friend, Fraud, or Fishy

- A Letter To Sen. Tom Harkin About For-Profit Charter Schools

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- Opinion: The Problem With Deceptive Degree Aggregators In The Search For Online Courses & Degrees

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

Cost of Education Domestic For-Profit Friend, Fraud, or Fishy Graduation Rates Infographics Recruitment Required Universities & Colleges

Leave a Reply