Cost of Education, Domestic, Education Quality, Ethics, For-Profit, Friend, Fraud, or Fishy, Gainful Employment, Graduation Rates, Legislation, Minorities, Opinion, Recruitment, Regulatory, Required, Retention Rates, Student Loans, Universities & Colleges - Written by Wired Academic on Friday, December 14, 2012 6:00 - 0 Comments

Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

Tom Baddley via Compfight

Tom Baddley via Compfight

By Paul Glader, Editor

The biggest burr under the saddle of For-Profit colleges is not government regulation but, rather, the bogus notion of “shareholder value.” To succeed long-term, for-profit schools may have to blow up that idea completely and privatize their schools or create new shareholder structures in which a private, enlightened foundation controls the bulk of stock in the company.

The For-Profit college “industry” has been living through hell since the Obama administration (via the department of education) has added regulations to curb predatory recruiting, lousy education quality and woeful dropout rates at the schools. The industry donated heavily to Republican presidential candidate Mitt Romney, hoping he would deliver on promises to deregulate the industry as Rep. John Boehner and others have done before. They hoped the governmental gravy train would start chugging again and yokes of regulation would be lifted off their necks.

Take a hanky, for-profit college “industry.” Dry your tears. Man up. You’ve got at least four more years of house-cleaning to do. The money won’t be easy. The competition will be tough. The path forward is narrow. Here are some radical thoughts on how to make it through by making a radical lifestyle change rather than just a makeover:

On the bright side, U.S. Secretary of Education Arne Duncan wants governor’s nationwide to raise the number of college degree holders to 60 percent in the next 8 years. That would put the U.S. back on top of the world for college graduates. At present, it’s 14th in overall degree attainment, according to the Organization for Economic Cooperation and Development. The For-Profit colleges should be able to help with that goal. New regulations aimed to improve graduation rates and job outcomes at for-profit colleges force them to improve their record in degree attainment by students.

The bigger problem facing for-profit colleges post-election, however, is the storming presence of two fierce competitors: 1) Massive Open Online Course providers such as Coursera, edX and Udacity, which are drawing some adult learners over to the idea of free, self-learning that could lead to degrees in the future. 2) Traditional universities that are ramping up for-credit online courses and degree programs.

The later trend is the bigger problem for the “industry” as, let’s face it, traditional colleges such as Indiana University and Georgetown University have far superior brands than University of Phoenix and Ashford University in the marketplace. The “industry” is looking more crunched on all sides strategically. Which should lead it to consider it’s branding, it’s structure and it’s overall mission. Most of all, it should consider who it is serving.

Within the mission statement of every publicly-traded college or university, one should find language that makes clear investors are one of many stakeholders of the institution and that the company’s greatest obligation is to its customers – the students. I trolled through the “investor” pages, recent presentations and mission statement marketing material for several of the key for-profit universities such as Apollo Group Inc.’s University of Phoenix, The Washington Post Co’s Kaplan University, Education Management Corp. and Bridgepoint Education Inc., which owns Ashford University. Several of these schools & companies such as Apollo and Kaplan are seeing a hemmoraghing of enrollments amid the competition.

Frankly, many of these schools are now “saying” the right things about serving students, improving operations. For example, Bridgepoint’s mission statement reads:

Bridgepoint thrives on an ethos of invention. We are innovators and educators who make learning more accessible, valuable, and meaningful for all. Our people are empowering learners to succeed.

In the third quarter conference call for Apollo Group investors, I searched “shareholder” and saw two references. I searched “students” and saw 49 references and most of them in a concerned tone by company management. That’s a good sign. But a problem persists in that the interest of investors – one of these school’s key investors – still runs toward getting a return on investment. Such investors want to see growth, growth, growth.

Get Off The Stock Markets

There’s a case to be made that such interests run counter to the history and mission of colleges and universities, period. They conflict with academic freedom and academic cultures. They conflict with the interest of students, which is to obtain a fantastic education at the lowest cost possible. Because an excellent education at a low price for students means taking some money out of investors pockets. But that’s a decision successful publicly-traded career colleges are going to have to make if they are to compete with traditional colleges and MOOCs in the long-run.

New York Times columnist Joe Nocera writes Aug. 10, 2012, in a column titled Down With Shareholder Value, that the modern notion of “shareholder value” – the notion that public companies exist first and foremost to serve investors – is bogus and flawed. Corporate raiders such as T. Boone Pickens and Carl Icahn have furthered this notion that executives serve shareholders. Nocera notes that this radical notion came out of academia during the booming Wall Street years in the 1980s. Nocera writes:

Shareholder value has long since become the mantra of the business culture. Corporate boards shower executives with stock options to “align” them with shareholders. “Underperforming” companies find themselves under siege from activist investors. Increasing shareholder involvement is viewed as the way to fix whatever ails corporate governance. Over time, “maximizing shareholder value” became viewed as the primary task of the corporation.

And, well, you can see the results all around you. They’re not pretty. Too many chief executives succumb to the pressure to boost short-term earnings at the expense of long-term value creation. After all, their compensation depends on it. In the lead-up to the financial crisis — to take just one extreme example — financial institutions took on far too much risk in search of easy profits that would lead to a higher stock price.

Now, though, it feels as if we are at the dawn of a new movement — one aimed at overturning the hegemony of shareholder value. Lynn Stout, a Cornell University law professor, has written a new book, “The Shareholder Value Myth,” in which she argues that there is nothing in the law that supports the idea that shareholders should be the only constituency that matters. Other academics, such as Roger Martin, the highly regarded dean of the Rotman School of Management at the University of Toronto, are critical of the emphasis on shareholder value. A number of chief executives, such as Howard Schultz of Starbucks, have said that companies need to have a larger purpose than merely raising the stock price.

And, most recently, in the Harvard Business Review, Jay W. Lorsch, a professor at Harvard Business School, and Justin Fox, the editorial director of the HBR Group (and a former colleague of mine at Fortune), published an article entitled, “What Good Are Shareholders?” Not much, is their answer.

Nocera points out that the shareholders are not well-suited to be “corporate bosses” because their goals are too short-term oriented, especially as high-frequency trading becomes the dominant form of stock trading. He argues that the emphasis on shareholders in the last two decades didn’t make companies noticeably better. He and others question the entire “shareholder value” notion – meaning shareholders are owners and managers are their “agents” - as flawed because as Justin Fox writes in the Harvard Business Review, “The more you treat executives that way, the more they are going to act like mercenaries, and the more they get away from seeing themselves as stewards of an organization with lasting value.”

There is a different way of seeing public companies, one that doesn’t just seek to return money to shareholders but to provide goods and services, create and sustain jobs, pay taxes and give foundation money to good causes in communities where it operates.

When I spent a year as a fellow at Columbia Business School – one of the top MBA programs in the world - in 2007-2008, it was clear to see that the notion of “shareholder value” was dying. Case studies and course discussions often centered on the notion of “stakeholder interest,” meaning that companies should consider investors as one important stakeholder. Other important stakeholders include employees, customers, one’s nation, community members and the environment.

A More Enlightened Model?

So how does a company break free from the mindset of shareholder value? How does it get away from the tyranny of short-term growth, ROI and dividends? How does it shift to a more enlightened, long-term approach that considers more stakeholders?

It may require more than re-branding of companies and shifts of internal reform to satisfy regulators. It may mean radical disruptions of business models or shareholder structures. It may mean for-profit companies going private. It may mean reversing shareholder structures where enlightened owners or foundations control the bulk of voting rights. It may mean family ownership structures that put managers with long-term views in the driver’s seat and causes interested investors to realize they are in the back seat as one of many stakeholders.

German companies such as the Bosch company follows this kind of model, with its foundation controlling the bulk of voting shares in the company (disclosure: I was a Robert Bosch Fellow for Young American Leaders in 2011-2012). Other German companies have a similar operating model including publishing giant Bertelsmann and optics firm Carl Zeiss AG. Carlsberg Brewing Co. in Denmark is another non-German example.

Back in the United States, some notable publicly-traded newspapers have enjoyed family control, including The New York Times (Sulzberger family), The Washington Post (Graham Family). The Wall Street Journal and Dow Jones & Co. were controlled by the Bankroft family before selling to Rupert Murdoch’s News Corp. in 2007. Central Newspapers Inc was controlled by the Pulliam family via a trust before it sold to Gannett Newspapers in 2000. Others such are owned by foundations such as the St. Petersburg Times in Florida (owned by Poynter Institute) and The Pittsburgh Post-Gazette (owned by the Block Family).

My view is that these family-owned companies tend to produce the best, quality and most independent journalism in America. Companies like Bosch and Carlsberg – if well-managed — also tend to have a much greater longevity than their peers.

In my mind, education is like journalism and a few other key industries that requires a long-term approach and a consideration of a customers needs and wants. Such considerations should come before the interests of investors. Which current for-profit colleges will be the most innovative and aggressive to remove the burr from their saddle, to innovate and thrive in the new higher education economy? Or, at the same hand of government regulators who made them rich, which of them will die a slow, regulated, painful and public death?

Glader is co-founder and managing editor of WiredAcademic.com. He’s a European Journalism Fellow at Frei University in Berlin, a former reporter at The Wall Street Journal. He’s written for The Washington Post, USA Today, ESPN.com, FastCompany.com and other publications.

Campus Buzz

We welcome Tips & Pitches

Latest WA Original Features

-

Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

-

Open University Enters Battle Of The MOOCs, Launches “FutureLearn”

-

Alvaro Salas As A Case Study In Crowd-Funding An Ivy-League Education

-

Jonathan Mugan: How To Build A Free Computer Within A Computer For Your Child

-

WGU Texas & Three Community Colleges Develop Individual-Paced College Courses

Paul Glader, Managing Editor

@paulglader

Eleni Glader, Policy Editor

Elbert Chu, Innovation Editor

@elbertchu

Biagio Arobba, Web Developer

@barobba

Ravi Kumar, Reporter & Social Media Editor

@ravinepal

Contributors:

Michael B. Horn

@michaelbhorn

Derek Reed

@derekreed

Annie Murphy Paul

@AnnieMurphyPaul

Frank Catalano

@FrankCatalano

Ryan Craig

@UniVenturesFund

Jonathan Mugan

@JMugan

Terry Heick

@TeachThought

Alison Anderson

@tedrosececi

The Pulitzer Prize winning investigation newsroom digs into for-profit education.

-

Most Viewed

- Inside Ashford University: A former staffer talks to WiredAcademic

- Pearson Llc + Google Expands LMS Business With "OpenClass" System

- Guest Column: Why Steve Jobs would have loved digital learning

- Citing IT Skills Shortage, IBM Wants To Expand Presence At Universities

- Terry Heick: The iPad's Past, Present & Future In Learning Environments

-

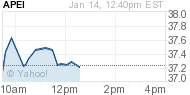

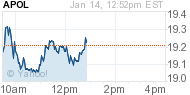

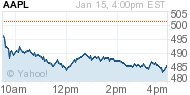

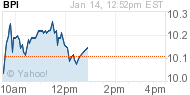

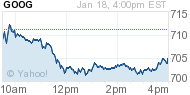

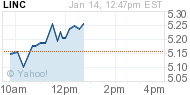

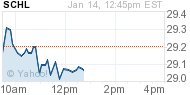

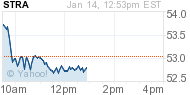

MARKET INTRADAY SNAPSHOT

- Education & Tech Companies We Follow

| APEI | 37.15 |  -0.31 -0.31 |  -0.83% -0.83% | ||

| APOL | 20.10 |  -0.26 -0.26 |  -1.28% -1.28% | ||

| AAPL | 495.00 |  +9.08 +9.08 |  +1.87% +1.87% | ||

| BPI | 10.33 |  -0.04 -0.04 |  -0.39% -0.39% | ||

| CAST | 0.061 |  0.00 0.00 |  +0.00% +0.00% | ||

| CECO | 3.49 |  -0.02 -0.02 |  -0.57% -0.57% | ||

| COCO | 2.62 |  -0.01 -0.01 |  -0.38% -0.38% | ||

| CPLA | 28.20 |  +0.06 +0.06 |  +0.21% +0.21% | ||

| DV | 24.29 |  -0.10 -0.10 |  -0.41% -0.41% | ||

| EDMC | 3.83 |  +0.04 +0.04 |  +1.06% +1.06% | ||

| ESI | 14.72 |  -0.02 -0.02 |  -0.14% -0.14% | ||

| GOOG | 723.405 |  -1.525 -1.525 |  -0.21% -0.21% | ||

| LINC | 5.16 |  -0.03 -0.03 |  -0.58% -0.58% | ||

| LOPE | 23.14 |  +0.01 +0.01 |  +0.04% +0.04% | ||

| PEDH | 0.45 |  0.00 0.00 |  +0.00% +0.00% | ||

| PSO | 19.56 |  -0.09 -0.09 |  -0.46% -0.46% | ||

| SABA | 9.30 |  +0.03 +0.03 |  +0.32% +0.32% | ||

| SCHL | 28.79 |  -0.18 -0.18 |  -0.62% -0.62% | ||

| STRA | 54.33 |  -0.23 -0.23 |  -0.42% -0.42% | ||

| WPO | 375.86 |  -0.92 -0.92 |  -0.24% -0.24% |

Domestic, Education Quality, For-Profit, Friend, Fraud, or Fishy, Graduate, International, Private, Public, Regulatory, Required, Universities & Colleges - Jan 14, 2013 6:00 - 0 Comments

Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

More In For-Profit

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Graphical Profile Of Today’s Online College Student

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

- Avenues: The World School Opens To Fanfare & Critics Of Elitist High-Tech

Blended Learning Domestic For-Profit International K-12 Private Required Technology

Infographics, Open Source Education, Required, Technology - Jan 12, 2013 9:25 - 0 Comments

Infographic: How to Search for Free Open Education Resources Online

More In Technology

- Tom Vander Ark: Canvas.net Shifts The MOOC Model Paradigms

- Columnist Annie Murphy Paul Predicts How Education Will Change In 2013

- Tom Vander Ark’s List Of Top 12 Papers On Digital, Blended & Competency Learning From 2012

- Teacher’s Voice: Alison Anderson On Launching Digital Magazines In Classrooms With Zeen.com

- Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

Blended Learning Education Quality Faculty Feature Flipped Classrooms Foreign Expansion International Interview Math MOOCs Open Source Education Personalized Learning Required Science Startups STEM Teachers Technology top Universities & Colleges

Domestic, Education Quality, For-Profit, Friend, Fraud, or Fishy, Graduate, International, Private, Public, Regulatory, Required, Universities & Colleges - Jan 14, 2013 6:00 - 0 Comments

Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

More In Friend, Fraud, or Fishy

- Opinion: The Problem With Deceptive Degree Aggregators In The Search For Online Courses & Degrees

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

- The Incredible Expansion Of Charter Schools In American School Districts

Charter Domestic Education Quality Friend, Fraud, or Fishy K-12 Minorities Required

Leave a Reply